| Country | GNI | PPP |

| Luxembourg | 84,890 | 64,320 |

| Norway | 87,070 | 58,500 |

| Kuwait | 38,420 | 52,610 |

| United States | 47,580 | 46,970 |

| Switzerland | 65,330 | 46,460 |

| Hong Kong, China | 31,420 | 43,960 |

| Netherlands | 50,150 | 41,670 |

| Sweden | 50,940 | 38,180 |

| Austria | 46,260 | 37,680 |

| Ireland | 49,590 | 37,350 |

| Denmark | 59,130 | 37,280 |

| Canada | 41,730 | 36,220 |

| United Kingdom | 45,390 | 36,130 |

|

| Country | GNI | PPP |

| Germany | 42,440 | 35,940 |

| Finland | 48,120 | 35,660 |

| Japan | 38,210 | 35,220 |

| Belgium | 44,330 | 34,760 |

| France | 42,250 | 34,400 |

| Australia | 40,350 | 34,040 |

| Spain | 31,960 | 31,130 |

| Italy | 35,240 | 30,250 |

| Greece | 28,650 | 28,470 |

| Korea, Rep. | 21,530 | 28,120 |

| New Zealand | 27,940 | 25,090 |

| Russian Federation | 9,620 | 15,630 |

| Brazil | 7,350 | 10,070 |

| China | 2,770 | 6,020 |

|

Brunei Darussalam and Singapore with a higher PPP than the U.S. and other small economies were excluded.

Nicaragua, Uzbekistan, Vietnam, Pakistan and India were lowest with PPP's less than $3,000

See: Global Purchasing Power

Parities and Real Expenditures (pdf) at the World Bank

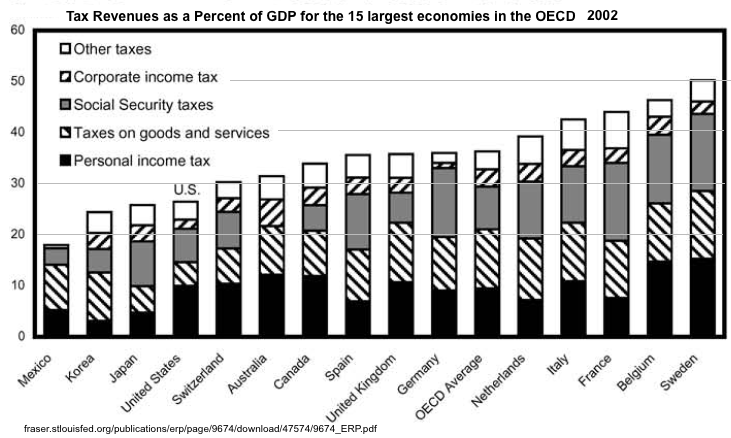

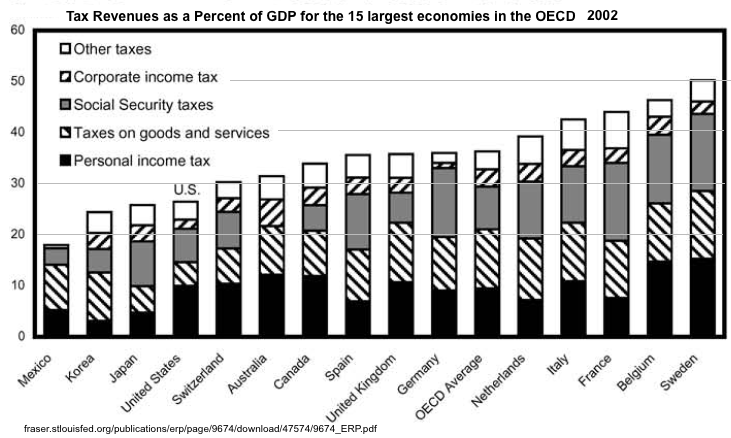

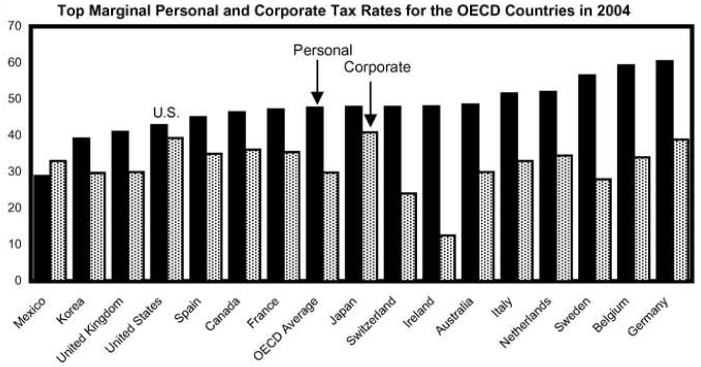

Taxes:

Source: fraser.stlouisfed.org/publications/erp/page/9674/download/47574/9674_ERP.pdf

See Also:

A Comparison Between The Us And Other Rich Nations at huppi.com

The income taxes people really pay - OECD Observer

Income Taxes By Country - Wikipedia

Business Taxes

Total Tax Index (TTI) relative to the US from KPMG

| Rank | Country | TTI |

| 2008 | 2010 |

| 1 | 1 | Mexico | 60 |

| 3 | 2 | Canada | 64 |

| 2 | 3 | Netherlands | 76 |

| 4 | 4 | Australia | 81 |

| 6 | 5 | United Kingdom | 88 |

| 5 | 6 | United States | 100 |

| 8 | 7 | Germany | 124 |

| 9 | 8 | Italy | 130 |

| 7 | 9 | Japan | 138 |

| 10 | 10 | France | 181 |

Total tax burden faced by companies, including income tax, capital tax, sales tax, property tax, miscellaneous local business taxes, and statutory labor costs.

Books:

Europe's Promise: Why the European Way Is the Best Hope for an Insecure Age, by Steven Hill

Links:

A Comparison Between The Us And Other Rich Nations at huppi.com

Best Countries

Crime Rates

NPR interview of Steven Hill

Countries with the largest populations

last updated 3 Mar 2010

|

Places

Places

Country Statistics

Contact

Country Statistics

Contact

Places

Places

Country Statistics

Contact

Country Statistics

Contact