last updated 18 Nov 2018

Best Mortgage Companies:

How to Find the Cheapest Mortgage When Rates Are Rising | Consumer Reports

Basic rule is shop around 3-5 quotes is good:

Personal factors in geting a lower rate:

Some of the things that will get you a lower rate:

- Shop around - Get at least 3 quotes.

According to Bankrate

rates (APR) in Nov 2018 for a 30 year fixed rate varied from 4.522% (Optimum)to 4.627%

Fees ranged from $0 to $2,280.

Interest Rate vs APR

Rate is the % you are paying on the principal balance.

APR (Annual Percentage Rate) is interest rate plus other costs such as broker fees, discount points and some closing costs, expressed as a percentage.

The APR is the same as the interest rate with no fees.

It will be 0.050% higher with $2,000 in fees.

-

Credit Score: Most non-government mortgage programs are priced by credit score, in 20-point tiers.

Example for a $215,000 30-year mortgage

| FICO Score | Rate | Payment |

| 760 - 850 | 4.59% | $1,106 |

| 700 - 759 | 4.81% | $1,134 |

| 680 - 699 | 4.99% | $1,158 |

| 660 - 679 | 5.2% | $1,186 |

| 640 - 659 | 5.63% | $1,244 |

| 620 - 639 | 6.18% | $1,320 |

Types of mortgages:

$200,000 loan

Type rate Payment

15 year fixed rate 4.40% $1,591/month for 15 years

30 year fixed rate 4.95% $1,068/month for 15 years

5/1 ARM 30 year 4.59% $1,024/month for 5 years

5/1 ARM - Rate is fixed for 5 years then is adjustable in 1 year increments.

- loan-to-value (LTV):

The LTV is a ratio that compares your property value and loan amount. The lower this ratio, the less you’ll pay, because lower LTVs are less risky for mortgage lenders.

20% down is standard

- Loan term:

Shorter term loans have lower interest rates and lower overall costs,

- Fixed vs Adjustable:

Adjustable is lower

- Loan type:

conventional, FHA, USDA, and VA.

- Points

You can pay points up front and get a lower rate.

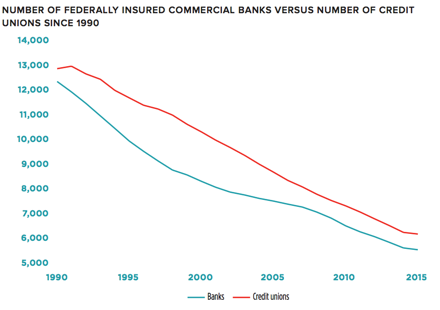

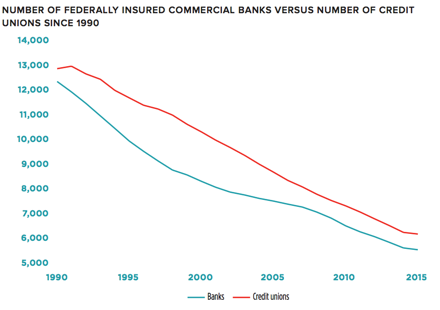

Type of Lender:

National, Local, Credit Union, online lenders like Quicken.

National banks Bank of America, Wells Fargo, Chase are usually slower and more difficult to deal with.

In 2013, Datatrac analyzed the average interest rate differences between credit unions and banks. When it came to car loans, banks' interest rates were about two percent higher. When it came to mortgages, rates were very similar.

The smaller lenders like Optimum First Mortgage list lower rates (e.g. 4.5% in Nov. 2018)(Because of volume discounts, they claim) and faster closing times.

A typical Commercial Bank and Credit union had rates of around 4.8%.

For the next few years, technological disruption, increased regulation,

changing consumer behaviors, and asset growth will be topics of constant

discussion for credit union leaders.

Source Filene Research Institute

Banks are getting away from mortgages and places like Quicken Loans are becoming more popular.

Lender Reviews:

At Mortgage Lenders - Reviews & Ratings - Bankrate.com they customer reviews of lenders on a scale of 1-5.

The following lenders got a 4.8-5.0 score with 100 or more reviews:

McGlone Mortgage Group

First Internet Bank

E-Click Lending

Optimum First Mortgage Inc.

JG Wentworth Home Lending

Aurora Financial

LoanLock

Northpointe Bank

Highest rated Banks and Savings & loans

x.x - Rating; (yy)- Number of reviews

Third Federal Savings and Loan 4.2 (67)

PNC Bank 4.7 (27)

Sample Rates:

Refinance a mortgage on a $500,000 single family home with a $160,000 mortgage principal balance and get $60,000 out in cash. 30 yr. fixed rate.

Note: When you enter your date in a place like BankRate or Investopedia, the results you get different results than you do by talking to a sales representative.

Lender rate APR Fees Points Payment

Quicken 5.0% $5,900 1.5 $1215 Agent quote

quickenloans

Optimum First Mtg. 4.25% 4.45% $1,975 $1,082 BestRate

Republic bankrate 4.375% 4.57% $895 BestRate

A mortgage broker may be able to get you better rates.

See Find A Mortgage Broker.

Links:

Mortgage Considerations, Tax deduction, payback time, points, " >

Debt

Bankrate.com - Compare mortgage, refinance, insurance, CD rates | bankrate.com

What Are the Main Types of Mortgage Lenders? | Investopedia

How to Find the Cheapest Mortgage When Rates Are Rising | Consumer Reports

Seven factors that determine your mortgage interest rate | Consumer Financial Protection Bureau

Links:

Financial Institution Disputes