financial

financial

Credit

Contact

Credit

Contact

Don's Home

financial

financial

Credit

Contact

Credit

Contact

|

Contents: FICO® | Scores from the 3 credit bureaus: | Score Checking: | Factors - Criteria - Reason Codes: | Problems: | Lost wallet - Identity Theft: |

Credit Reporting Agencies (Credit Bureaus):

TransUnion (www.tuc.com) 1-800-888-4213

EquiFax (www.equifax.com) 1-888-766-0008

Experian (formerly TRW) (www.experian.com) 1-888-397-3742

You should monitor all three credit bureaus because some institutiions only report too one.

As a result of the FACT Act (Fair and Accurate Credit Transactions Act), each legal U.S. resident is entitled to one free copy of their credit report from each credit reporting agency once every twelve months. This information is available at the government-sanctioned but credit bureau-operated AnnualCreditReport.com

Credit Scores:

The most commonly used score is FICO® (Fair Isaac Corporation)

VantageScore is another similar rating system.

A FICO® score generally ranges from 300 to 850

Median US: 723

769 at Equifax was better than 67%.

The scores vary by Credit bureau.

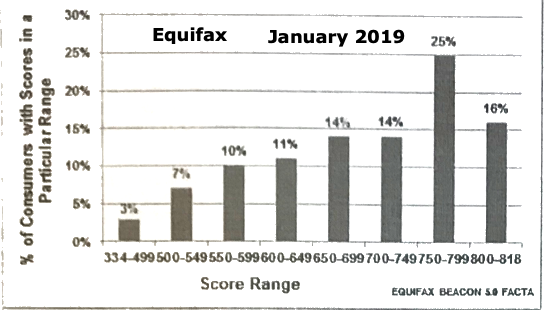

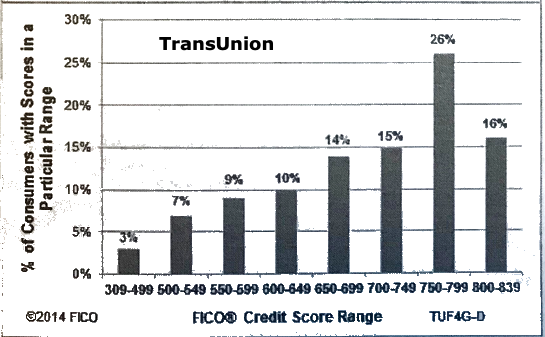

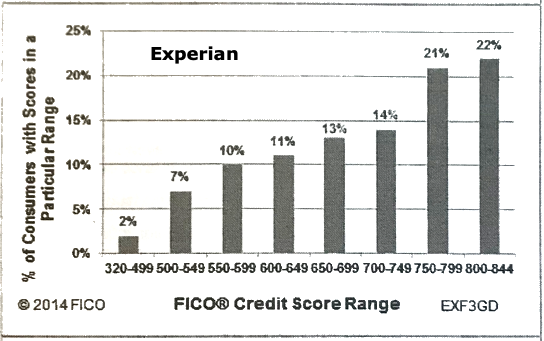

A sample in Jan 2019

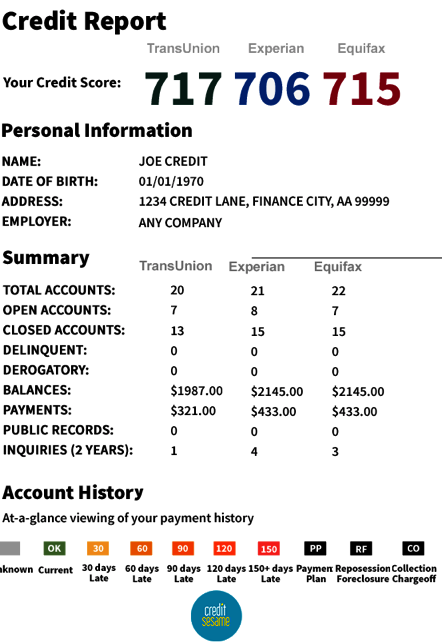

| Equifax | TransUnion | Experian | |

|---|---|---|---|

| % greater than 750 | 41% | 42% | 43% |

| My Score | 769 | 755 | 784 |

| CreditSesame | 715 | 717 | 706 |

| Distribution 2018 | ||

|---|---|---|

| FICO® Score Range | Percentage of U.S. Consumers | Percentage With Lower Scores |

| 800-850 | 20.7 | 79.3 |

| 750-799 | 19.0 | 60.3 |

| 700-749 | 17.1 | 43.2 |

| 650-699 | 13.2 | 30.0 |

| 600-649 | 10.0 | 20.0 |

| 550-599 | 8.5 | 11.5 |

| 500-549 | 6.8 | 4.7 |

| 300-499 | 4.7 | N/A |

660 is generally regarded as potentially subprime and represents an important break point for creditworthiness.

660 is generally regarded as potentially subprime and represents an important break point for creditworthiness.

760 and above should get you the best interest rates.

See Mortgages

Scores from the 3 credit bureaus:

Scores from the 3 credit bureaus:

At Why are my FICO® Scores different for the 3 credit bureaus? | myfico.com they say,

"While most of the information collected on consumers by the three credit bureaus is similar, there are differences. For example, one credit bureau may have unique information captured on a consumer that is not being captured by the other two, or the same data element may be stored or displayed differently by the credit bureaus."

See: What the Differences Are Between Equifax, TransUnion, & Experian | CreditSesame

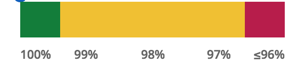

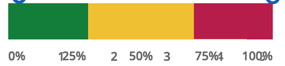

30% Debt Usage - The amount of debt, expressed as the ratio of current revolving debt (credit card balances, etc.) to total available revolving credit (credit limits)

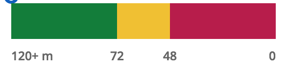

15% Credit Age - Average length of time (months) you've had each account.

10% Account Mix - Types of credit used (installment, revolving, consumer finance)

The mix of accounts you have--your student loans, auto loans, mortgages, and revolving credit cards make up 10% of your credit score. Creditors like to see this mix because it shows them you're capable of handling all types of accounts.

It seems to be just the number of credit accounts you have.

10% Inquiries - Recent search for credit and/or amount of credit obtained recently

Soft inquiries (e.g. Mortgage application) don't count.

Soft inquiries (e.g. Mortgage application) don't count.

I got a score of 770 with the excellent ratings in all the categories except "Inquiries", but number of inquiries where I got a poor score.

I had 5 inquiries in the last 2 years which put me at the bottom of that category.

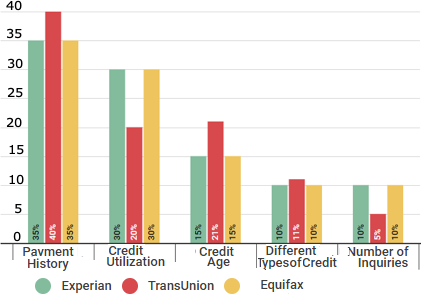

The weighting is slightly different for transunion.

See more detailed results of specific factors below.

Chase's Free Credit Score | Credit Journeysm | Chase.com does the same thing.

Get monthly or quarterly($30) 3-bureau credit reports from MyFICO

They include things like:

"A bankcard account was removed from your credit report"

"A new inquiry was added to your credit report"

"Your credit score has increased from 758 to 761"

Factors - Criteria - Reason Codes:

When applying for a mortgage they sent a report with scores from all 3 credit bureaus with scores and 4 codes like "18: Too many delinquent accounts".

A lender requires 4 codes to decline a loan based on credit score, so I guess no matter how good your score is they give the lenders a reason to decline.

"Too many delinquent accounts" may be from a couple of payments more than 30 days late over the last 6 years.

So with scores from 755 to 784 they could legally decline a loan based on credit.

These are called "reason codes" or "adverse action codes,"

My bank report showed 100% of payments online, but all three credit bureaus showed "Too many delinquent accounts" as a negative.

Each bureau showed 4 factors which were not consistent.

Two more codes were on 2 of the reports and 3 codes were on only 1 report.

Apparently credit score is based on 2-3 years of data while "reason codes" can go back 6 years.

The description of "18: Number of accounts with delinquency", at Experian says,

"Missed and late payments, including the number of

late payments, how late they were, and how recently

they occurred."

The explanation from CreditBoards.com below says,

They count anything that was 30 days late from six and a half years ago.

At Making sense of credit scores... - Credit Forum - CreditBoards they show a report similar to the one I got with their comments in red.

Me:

Equifax: (called a beacon score) 749

00014 Length of time accounts have been established

FICO® likes to see long established accounts. The averge age of consumers accounts is about 14 years. If yours is under that, you'll most likely get this factor. To me, this is one of the least important of all FICO® codes and the one you can do nothing about except let time pass.

00002 level of delinquincy on accounts

You'll get this if you have any deliquent account information on your report, even one 30 day late from six and a half years ago. Based on your scores, I'm guessing you don't have much deliquent account information. If this worries you, dispute the information and try to have it deleted.

00033 proportion of loan balances to loan amounts is too high **(we owe too much on our loans???)**

What a lame reason. You get penalized for having a high balance on an installment loan. Well duh FICO!!!!! Of course the balance is going to be high until the loan is paid down. That's the way installment loans work!!!! salamanders!

00004 too many bank or national revolving accounts **(what are bank or national revolving accounts?)""

Visa, Mastercard, Amex & Discover. FICO® only likes to see 2-3 of these.

05 number of accounts with balances **(I have too many accounts with balances???)"

18 number of accounts delinquent

24 lack of recently reported balances on revolving/open accounts **(what does this mean?)**

012 insufficient length of revolving credit history

024 no recent revolving balances **(what does this mean?)**

005 too many accounts with balances

14 length of time accounts have been established

09 number of accounts opened within the last 12 months 18 number of accounts delinquent

Those comments often can be erroneous, and really you will have no problem quallifying for a great mortgage. I wouldn't get too hung up on the comments because like I said they can be BS",

But the factors are not applied evenly throughout different

credit profiles. For example, someone with 10 years of credit history and no negative

information present may get the "length of credit history" as a negative factor.

Lost wallet - Identity Theft:

Links:

Experian (Fair Issac model score): 744

14 length of time accounts have been established

See above

FICO® doesn't like to see too many accounts with balances. What the right number is, nobody knows. This factor is part one of the catch-22.

See above

Part two of the catch-22. Although FICO® doesn't like to see too many accounts with balances, it also doesn't like to see accounts with no balances. Go figure. Ostensibly, this is because accounts with no balances mean you're not using the accounts, and FICO® has a tough time figuring out how you use credit if you don't use your accounts.

Trans Union (epirica 950 score): 698

014 insufficient length of credit history

See above

Your credit card history is shorter than the average.

See above

See above

My husband' scores and comments:

Equifax - 746

00014 Length of time accounts have been established

00002 level of delinquincy on accounts

00033 proportion of loan balances to loan amounts is too high

00004 too many bank or national revolving accounts

Experian - 764

06 number of finance company accounts **(what does this mean?)**

FICO® doesn't like to see finance company loans because these kinds of loans typically are of lower quality than bank loans. To me, a rather stupid reason as you're being penalized for the type of loan rather than having your repayment history of that as the only factor.

FICO® doesn't like to see too many accounts opened in a short period of time. Sometimes this may mean only one account.

Trans Union - 759

006 too many consumer finance accounts

028 too many established accounts **(does this mean he needs to dispute those accounts that say open but are actually closed?)**

I wouldn't mess with any positive accounts. You may end up getting them deleted rather than edited.

002 delinquency

012 insufficient length of revolving credit history

Keep in mind that you basically have excellent scores. Each of these reasons is only having a minor impact. Don't worry too much about them. If you work on any deliquencies and pay down some of your balances, your scores may go up. If you don't, you still have excellent scores that time will improve even more.

Someone

else with only 7 years of history and a whole slew of negatives may get the "length of

credit history" as a positive factor. This is because FICO® needs to justify it's scores

with reasons, but in so doing, often gives specious factors that don't seem unreasonable

until the factors and the data behind them are compared to other reports and scores.

Problems:

A 2012 Federal Trade Commission study found that 20% of Americans have errors on their credit reports, and for a quarter of this group, the errors are large enough to impact their ability to get credit!

You can file credit disputes with the credit bureaus.

You can ask the credit bureaus to put a "fraud alert" or "credit freeze" on your fle.

CreditSesame

AmEx Launches Credit Score Tool for Everyone - NerdWallet

FICO® Score Factors Guide - Experian |figfcu.com

Free Credit Reports at ftc.gov

BankRate.com's guide to managing your credit

www.myfico.com

Find a service with all 3 scores | Top 10 Credit Report

FICO: Artificial Intelligence + Human Intelligence | FICO(R)

FICO: Artificial Intelligence + Human Intelligence | FICO®

Sample Credit Report Summary | Credit.com